Guarantee of conformity and security for your exchanges.

PDP e-invoicing at TX2 CONCEPT.

As part of the 2020 and 2024 Finance laws, the French government has decided to make the switch to electronic invoices mandatory for all companies subject to VAT from 2026.

The obligation for electronic invoicing, or e-invoicing, is accompanied by an obligation to transmit transaction data, called e-reporting.

The move to mandatory electronic invoices is an opportunity for businesses. The dematerialization of invoices makes it possible to secure and automate processes that are often time-consuming and have little added value.

As a Partner Dematerialization Platform registered PDP n°15 with reservations, TX2 CONCEPT is responsible for the tax and legal requirements on behalf of its clients.

Our TX2 Cloud solution ensures that you comply with French and international legal constraints. It allows you to globalize the dematerialization of all your invoices.

Take advantage of the benefits of e-invoicing today and be ready for tomorrow’s regulations!

Our e-invoicing solutions

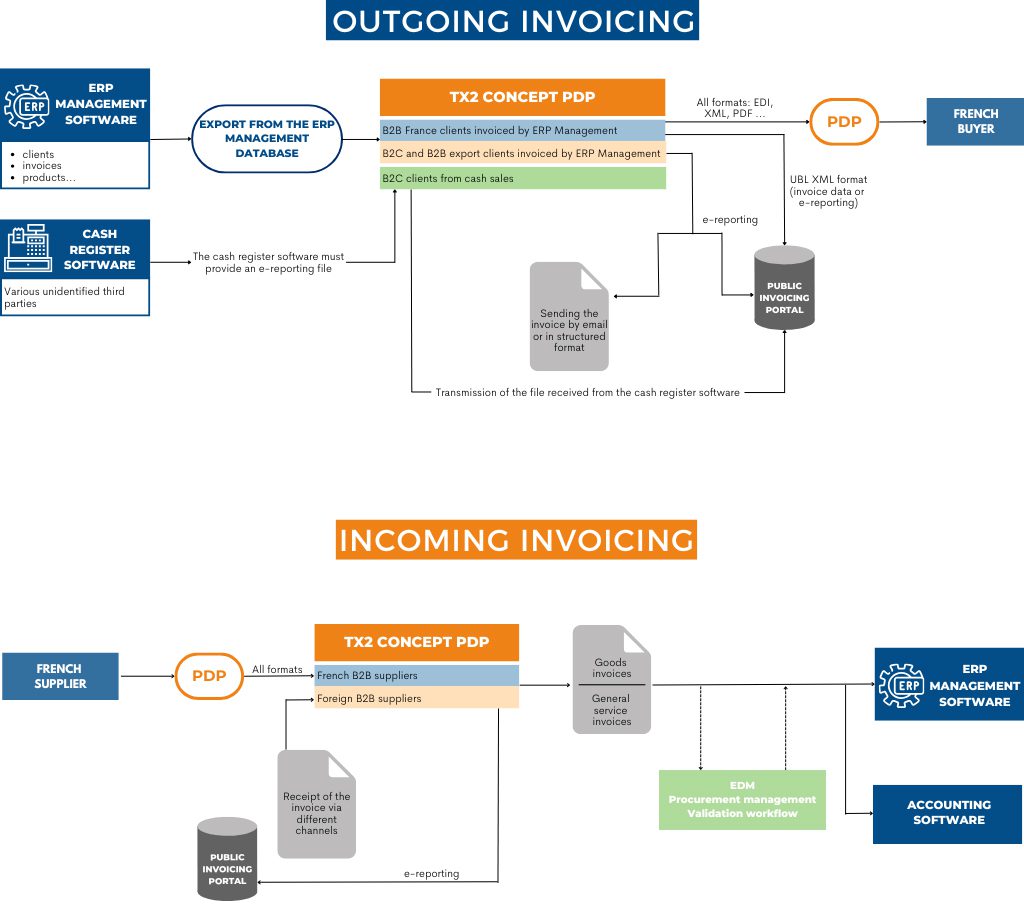

Our solution allows you to dematerialize your outgoing invoices from a structured or PDF file and send them to your clients via different channels.

With our solution, invoices sent by your suppliers are translated and integrated directly into your ERP or management software, whatever their formats.

Our technical expertise

Sector standards and formats

EDIFACT, Odette/VDA, Tradacom, ANSI X12, XML (UBL, CII, etc.), Factur-X, SAP IDOC …

Communication protocols and networks

AS2, OFTP, SFTP, FTPS, HTTP/S, SMTP (e-mail), SAP RFC, Allegro, X400, ENX, OpenText, API …

ERP compatibility

Designed to integrate with all management software.

TX2 CONCEPT continually develops and optimizes connectors with all types of management software.

Unlimited possibilities for interfacing

Electronic invoicing for which sectors ?

The transition to e-invoicing concerns all business sectors.

How does e-invoicing with a PDP work ?

Make sure you comply with the new legal obligations.

Why choose the TX2 CONCEPT PDP?

+25 years of experience

One of the first providers of tax dematerialization solutions for invoices. Our solutions are certified by specialized firms and GS1.

Functional coverage

Complete overhaul of our e-invoicing offering to cover all the functionalities linked to the 2026 reform.

Modern tools

Solution based on open APIs with a 3-tier architecture for a secure system. An invoice database based on the UBL format.

A complete offer

From consulting to integration with the possibility of carrying out a preliminary “360°” study. Possibility of complete integration with an EDM via APIs.

Millions of electronic invoices pass through our platforms, why not yours?

What a PDP brings you.

Choose a French PDP.

Security of your data

Choose a solution that guarantees the security of your data (ISO 27001 certification) and compliance with legal constraints.

Manage different formats

A PDP can handle any type of format, in addition to Factur-X, XML UBL and XML CII, such as EDIFACT, for example. You can therefore maintain what's existing if you already use EDI.

Compliance checks

A PDP has an obligation to monitor the compliance of the e-invoicing and e-reporting flows that it processes.

A complete tailored offer

Benefit from a functional offer and tailor-made service.

A unique platform

Consolidate all flows from France and subsidiaries abroad on a single platform.

A certified solution.

Our invoicing solution is certified ISO 27001.

Tailor-made solutions

We are editor and integrator of our software. This means that we can offer you tailor-made solutions, adapted to your business needs.

Complete offer

We have an offer that covers all of your needs.

Secure data

Your data is stored in France and carefully secured. TX2 Concept is ISO 27001 certified.

Dedicated support

You benefit from a support service available in several languages.

Interoperable solutions

We are signatory to the interoperability charter. This ensures connectivity with your partners.

Project methodology

We rely on the joint application of agile and DevOps methodologies to enable us to achieve our quality and responsiveness objectives.

Any need, any question?

Our team is here to listen to you and will be happy to answer you.