Summary :

- Essential information on the transition to e-invoicing in France

- The 5 steps to prepare for e-invoicing

- How does TX2 Concept support you in your preparation?

From September 1, 2026, electronic invoicing will become an obligation for all French companies. This change represents a real revolution for administrative and accounting management. But how can we prepare effectively for this essential transition?

In this article, discover the five key steps to successfully transition to electronic invoicing.

You will also discover how TX2 Concept can support you in this transformation, by offering solutions adapted to your needs for a smooth transition and assured compliance.

Essential information on the transition to e-invoicing in France

As you certainly know, from September 1st, 2026, in France, all companies subject to VAT must be able to receive electronic invoices.

The obligation to issue electonic invoices depends on the size of your company:

- September 1st, 2026 for large companies and mid-sized companies;

- September 1st, 2027 for SMEs, VSEs and microenterprises.

To find out if your company will be required to invoice electronically, do not hesitate to consult the DGFIP practical sheets.

The specific characteristics of the reform

Concretely, this means that invoices exchanged between professionals must be transmitted in a standardized electronic format. Please note, a PDF or scanned invoice is not considered electronic.

The novelty also lies in the fact that these can no longer be exchanged directly between a client and their supplier. They must go through the State’s Public Invoicing Portal (usually called PPF in french). Either directly or via a private platform.

The transmission of this data to the tax administration will ultimately allow the pre-filling of VAT returns.

B2C and B2B international invoices will be affected by an e-reporting obligation. To find out more, do not hesitate to consult our article Everything you need to know about e-reporting.

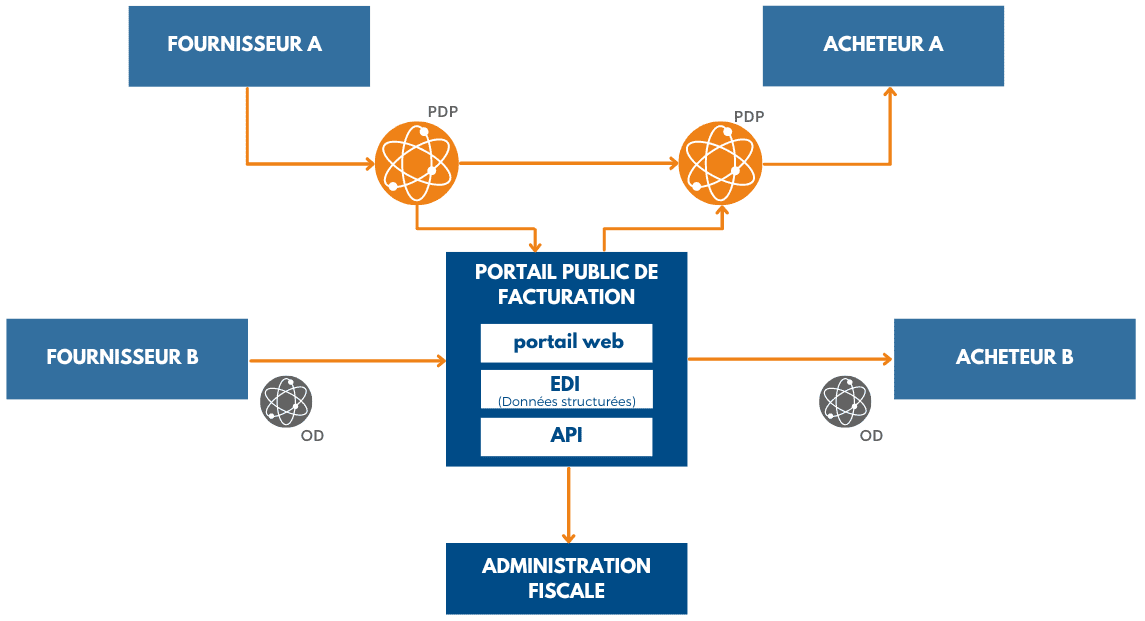

As a reminder, here is the architecture planned for this reform.

E-invoice: what advantages?

These new obligations should not be seen as a constraint, but an opportunity. Indeed, dematerialization has many advantages for businesses.

To name just some:

- Reduced costs related to printing, processing time and storage of paper invoices;

- Save time thanks to process automation, which allows your employees to concentrate on tasks with higher added value;

- More security in data management and reduction of the risk of error;

- Reduction in disputes and payment delays.

The 5 steps to prepare for e-invoicing

To ensure that you comply with the new regulations when the time comes, it is essential to anticipate your steps. You need to start auditing your processes and defining your needs today.

This new regulation will impact your organization as a whole. It is therefore important to consider both the technical aspects, but also the organizational and human aspects.

Here are some examples of points to study before your invoice dematerialization project.

1. Form an internal working group

The objective here is to form a working group on e-invoicing which represents the services mainly impacted by these changes. These include, for example, members of management, the accounting department and the IT department.

Once the group is formed, make sure that everyone has the same level of knowledge about the reform. You can then move on to the next step.

2. Audit your invoicing processes

Before thinking about which solution you should choose, it is necessary to review your current processes. Accurate mapping of your invoicing flows will save you time for the next steps. This will also allow you to clearly identify your needs, to choose the most suitable solution.

Here are some questions to help you:

- What are the different use cases regarding invoicing in your company?

- What software(s) do you have? ERP, accounting software, cash register software, EDM, or any other management software?

- Are you already dematerializing all or part of your invoices? In what format(s)?

- What volume of invoices do you exchange? How will it evolve in the coming years?

- Do you already do EDI for invoicing or other commercial documents (orders, shipping notices, etc.)?

- Do you have an invoice or EDI dematerialization service provider? Is he positioning himself as OD or PDP?

- Are your invoices compliant? Do they contain all the mandatory information?

- Would it be relevant to generalize e-invoicing for all your invoicing flows?

3. Carry out an inventory of your suppliers and buyers

Now that you have review your processes, you must also make a state of play of your business partners.

List your suppliers and buyers. For each, indicate the volume of invoices you exchange.

You can also indicate in which format you currently exchange: EDI, PDF by email, etc.

This step can help you prioritize which partners to implement invoice dematerialization as a first step.

It may also be interesting to see with your partners which lifecycle statuses are essential for them. Apart from the mandatory statuses “deposited”, “rejected”, “refused” and “cash”, it is possible that some of them need other recommended or free statuses in their accounting management.

You will thus be able to ensure that the platform you choose is able to manage these different statuses.

4. Choose an e-invoicing solution

The steps carried out previously allowed you to precisely define your needs.

Now you have to choose between these 3 options:

- Send and retrieve your invoices directly from the PPF;

- Opt for a Dematerialization Operator as an intermediary;

- Choose a Partner Dematerialization Platform.

If you exchange directly with the PPF:

- You cannot communicate directly with your partners;

- You must be able to transmit your invoices in Factur-X, XML UBL or XML CII format on the PPF;

- If you are exchanging a small volume of documents, you will be able to enter each invoice manually on the public portal;

- You must be able to transmit e-reporting and lifecycle data.

If you go through an OD:

- You cannot communicate directly with your partners;

- Your Dematerialization Operator can take care of translating your invoices into one of the formats expected by the PPF;

- It can also manage your e-reporting and life cycle data;

- It can offer added services, such as validation workflow management.

If you go through a PDP, registered with the DGFIP:

- You can communicate directly with your partners in other formats, such as EDI. This allows you to maintain what exists if you are already dematerializing your documents;

- Your PDP is responsible for transmitting your invoices, e-reporting and life cycle data to the PPF;

- It controls the conformity of your flows;

- It guarantees the security of your data (ISO 27001 certification);

- If the public portal is unavailable, you will be able to continue to communicate with your partners;

- Your PDP is also responsible for receiving and automatically integrating your flows into your management software.

Note that an OD and a PDP can join forces to provide a complete and secure solution for electronic invoicing. We are notably a partner of Docuware and DimoSoftware.

Also, do not hesitate to ask your ERP, EDM and other software if they are partners of one or more PDPs. For example, VIF chose TX2 Concept as its PDP partner.

5. Prepare for change management

This last step should not be neglected. Indeed, the transition to e-invoicing will revolutionize the organization of businesses. Anticipating these changes will allow you a more peaceful transition.

To begin, identify the employees who will be impacted. Then think about the training and communication plan on the new processes and tools.

The communication part is understood both internally and externally. Inform your partners of your switch to e-invoicing. This will allow you to guarantee the fluidity of your exchanges.

How does TX2 Concept support you in your preparation?

As a PDP, TX2 Concept supports you in your compliance.

Our TX2 Cloud e-invoicing solution allows automated invoice processing. It is able to manage all types of formats: EDI (EDIFACT, X12, TRADACOM standards, etc.), Factur-X, PDF, XML, etc.

As an EDI expert, we are interoperable with many platforms, including future PDPs, as well as with interoperability networks. Our ERP expertise also allows us to interface with the majority of management software on the market.

The best part of our TX2 Cloud PDP platform? We offer a system with open API for providing data on demand.

Finally, know that our Web EDI will also comply with the new requirements. This option is particularly suitable for companies exchanging a small volume of documents using EDI.

In order to best prepare your e-invoicing project, do not hesitate to contact us. We can discuss your project together.

We can also advise you to contact some of our partners who would be able to support you in a personalized way during these stages.